Card transactions remain at the heart of the global financial ecosystem—powering purchases across e-commerce, point-of-sale, mobile, and contactless channels. Yet behind the scenes, outdated switch infrastructure is becoming a critical liability. As expectations for speed, security, and scalability intensify, modernizing your card transaction switch is no longer just a technical upgrade—it’s a business-critical transformation.

Why Modernizing Card Transaction Switches Is a Strategic Imperative?

The global surge in contactless, card-not-present (CNP), and tokenized transactions is reshaping how card payments happen—demanding a switch that can keep up. Today’s financial institutions need:

- Routing and clearing of transactions

- Seamless multi-scheme integration (Visa, Mastercard, Amex, Discover, and more)

- Support for EMV, NFC, 3DS2.0, and tokenization

- Rapid onboarding of new BINs, issuers, and acquirers

Why This is Technology Transformation (Not Just an Upgrade)

- Nimble Architecture for Rapid Innovation: Modular, microservices-based design enables new feature rollout in weeks, not months. Launch capabilities like tokenization, 3DS2.0 authentication, or dynamic routing rules through targeted updates, avoiding full-system overhauls.

- Elastic Cloud-Native Scaling: Containerized workloads (Kubernetes/Docker) auto-scale to handle transaction spikes during peak seasons or promotional events. Pay only for consumed resources – no overprovisioned legacy hardware

- Compliance by Design: Card industry standards (e.g., PCI DSS 4.0) are embedded into core transaction processing – not retrofitted post-migration.

- Infrastructure Modernization: Replace monolithic legacy systems with API-first, cloud-agnostic platforms (AWS/Azure/GCP).

Major Factors Accelerating the Need

For banks, payment switch modernization has shifted from a "future initiative" to an urgent competitive necessity. This transition compels a fundamental rethink: modern payment switches are the strategic engine to capture new revenue, retain customers, and future-proof operations.

Critical drivers compelling action now:

- Obsolescence of legacy systems: Inability to support modern card technologies like tokenization or instant authorization.

- Increasing competition: Pressure from fintechs and neobanks offering superior card experiences.

- Security & compliance demands: Rising card fraud and stricter mandates (e.g., PCI DSS 4.0).

- Scalability & performance: Handling peak card transaction volumes during holidays/sales events.

- Interoperability & new payment methods: Integrating wearables, digital wallets, and cross-border card schemes.

Top 5 Migration Pitfalls in Card Switch Modernization

1. Undocumented Customizations

Years of embedded logic—custom routing, MCC-based exceptions, and issuer-specific workflows—often lack documentation. Failure to replicate these leads to authorization declines, interchange leakage, or non-compliance.

2. Overloaded Scopes (aka the Feature Creep Trap)

Bundling non-core initiatives (e.g., loyalty engines or dispute workflows) with switch migration creates complexity. This dilutes focus on core card processing, causing delays as teams manage interdependent systems instead of prioritizing transaction integrity.

3. Invisible Cost Drivers

Scheme certification fees, EMV test scripting, and fallback routing setups are frequently underestimated. These card-specific requirements emerge late in migration, triggering budget overruns—especially for multi-scheme integrations or PCI validation.

4. Testing Gaps for Card Use Cases

Vendor tests often miss edge cases like cashback requests, balance inquiries, or fallback PIN handling. Real-world card scenarios (e.g., ATM reversals during network timeouts) fail post-launch without rigorous transaction lifecycle testing.

5. End-User Change Resistance

Operations teams accustomed to legacy interfaces may resist new workflows. Staff familiarity with manual card exception handling (e.g., forced approvals) slows adoption—requiring role-specific training and reskilling.

Legacy vs Modern: Card Switch Comparison

| Attribute | Legacy Switch | Modern Card Switch |

|---|---|---|

| Architecture | Monolithic | Microservices-based modular design |

| Deployment | On-premise, siloed | Cloud-native, containerized |

| Scheme Integration | Often limited, scheme-specific | API-driven, supports multi-scheme |

| Compliance | Periodic updates | Embedded (PCI DSS, EMVCo, ISO 8583/20022) |

| Scaling | Hardware-bound | Elastic autoscaling |

| Innovation | Quarterly release cycles | Weekly per-service upgrades |

| Resilience | Active/Active | Active/Active |

A Proven Framework for Successful Migration

Crucially, every phase demands collaboration with specialized payment switch partners – their battle-tested methodologies and on-tap expertise de-risk execution and accelerate outcomes.

| Phase | Key Focus Areas | Strategic Outcomes |

|---|---|---|

| 1. Assessment | Assessment & readiness evaluation | Establish baseline capabilities, identify migration feasibility |

| 2. Planning | Gap analysis & customization mapping | Define scope, uncover legacy complexities, align with future needs |

| 3. Validation | Sandbox & regression testing | De-risk migration via simulated runs and pre-launch validation |

| 4. Certification | Certification with networks/schemes | Ensure compliance and readiness for production-grade operations |

| 5. Execution | Gradual rollout: Low-risk segment → High-volume transactions | Minimize disruption, build confidence through staged deployment |

| 6. Stabilization | Monitoring, incident handling & performance tuning | Optimize system performance and ensure seamless post-migration ops |

What Should You Look for in a Modern Payment Switch?

- Event-driven, microservices architecture: Enables real-time responsiveness, modular deployment, and easier scalability.

- High availability & horizontal scalability: Guarantees uptime and performance under heavy transaction loads through resilient design.

- Multi-channel & multi-instrument support: Supports cards, wallets, UPI, QR, and more—across mobile, online, and physical channels.

- Strong observability (monitoring & logging): Provides deep visibility into system health, transactions, and performance for faster issue resolution.

- Interoperability & new payment methods: Integrating wearables, digital wallets, and cross-border card schemes.

Buy vs. Build vs. Partner: Choosing Your Migration Path

The optimal approach depends on your institution's profile:

| Model | Best For | Why? | Key Considerations |

|---|---|---|---|

| BUY | Global Tier-1 Banks |

|

|

| BUILD | Tech-Focused Institutions |

|

|

| PARTNER (Recommended) | Mid-Size Banks & Credit Unions |

|

Ensure partner has:

|

Switch-Specific Scenario: Implementing Active-Active Architecture

Why does it matter now for card transactions?

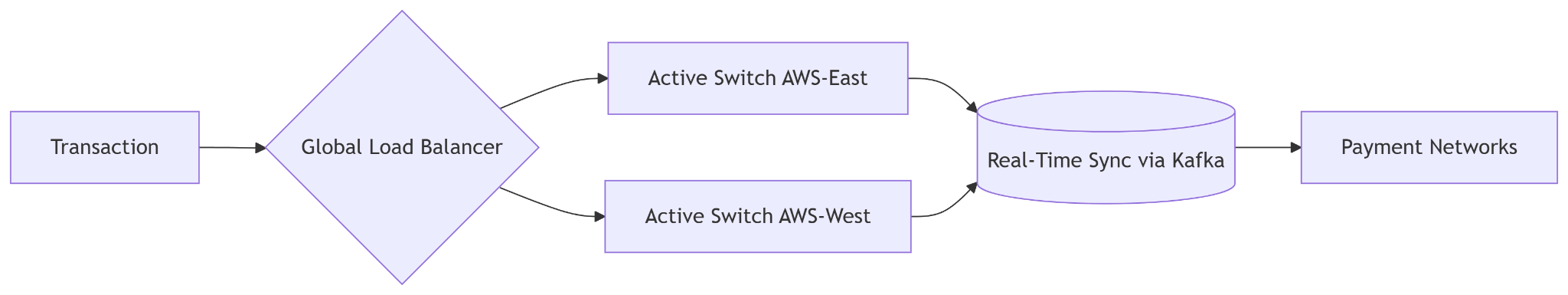

Modern card processing demands 100% uptime. Active-active architecture eliminates single points of failure through:

- Zero downtime during outages: Automatic failover prevents card transaction declines during system/maintenance events.

- Instant transaction rerouting: Seamless redirect during regional failures or network congestion.

- Regulatory resilience: Meets PCI DSS disaster recovery mandates for uninterrupted processing.

- Peak volume handling: Scales horizontally during holiday/sales surges without auth delays.

Implementation essentials:

Critical success factors:

- Latency: <50ms between regions (achieved via dedicated fiber links).

- Data sync: Stateful session replication for ATM/POS continuity

- Interchange optimization:Dynamic routing logic to steer high-value card volumes toward preferred networks/schemes.

Real impact scenario:

Think about a major Tier 1 bank with an active-active switch covering two locations. Now, active switch instances at its main East Coast data center have become inaccessible during a major power outage. The worldwide load balancer identified the failure and directed all incoming payment traffic—over 2 million transactions per day—within milliseconds to the fully synchronized West Coast instances. Customers experienced zero disruption. They could still withdraw money from ATMs, pay at stores, and use the mobile app without interruption. The bank continued to maintain its reputation and revenue flow seamlessly.

Conclusion

Payment switch migration is not merely an IT project; it's a strategic imperative to building a more resilient, agile, and competitive financial institution for the future world of payments. The complexities are many, but enhanced customer experience, operational efficiency, and security, combined with the ability to innovate at speed, are some game-changing gains

At Verinite, we deliver outcome-led migration powered by proven accelerators, expert talent, and a strategic partner ecosystem. We don’t sell generic services—we specialize in card transaction infrastructure.

Our team brings 14+ years of card-specific experience, including:

- Issuer/acquirer switch modernization for EMV, contactless, and tokenization

- Deep execution across Visa, Mastercard, Discover & domestic card schemes

- BIN migration, network routing logic, and switch rule configuration

Why does it matter? Strategic oversight from experts who’ve migrated 100+ card environments.

- What is the outcome: Reduced rework, faster go-live, and alignment with card business objectives.

We provide more than migration—we offer a card-focused ecosystem:

- Card & switch specialists (not generalists)

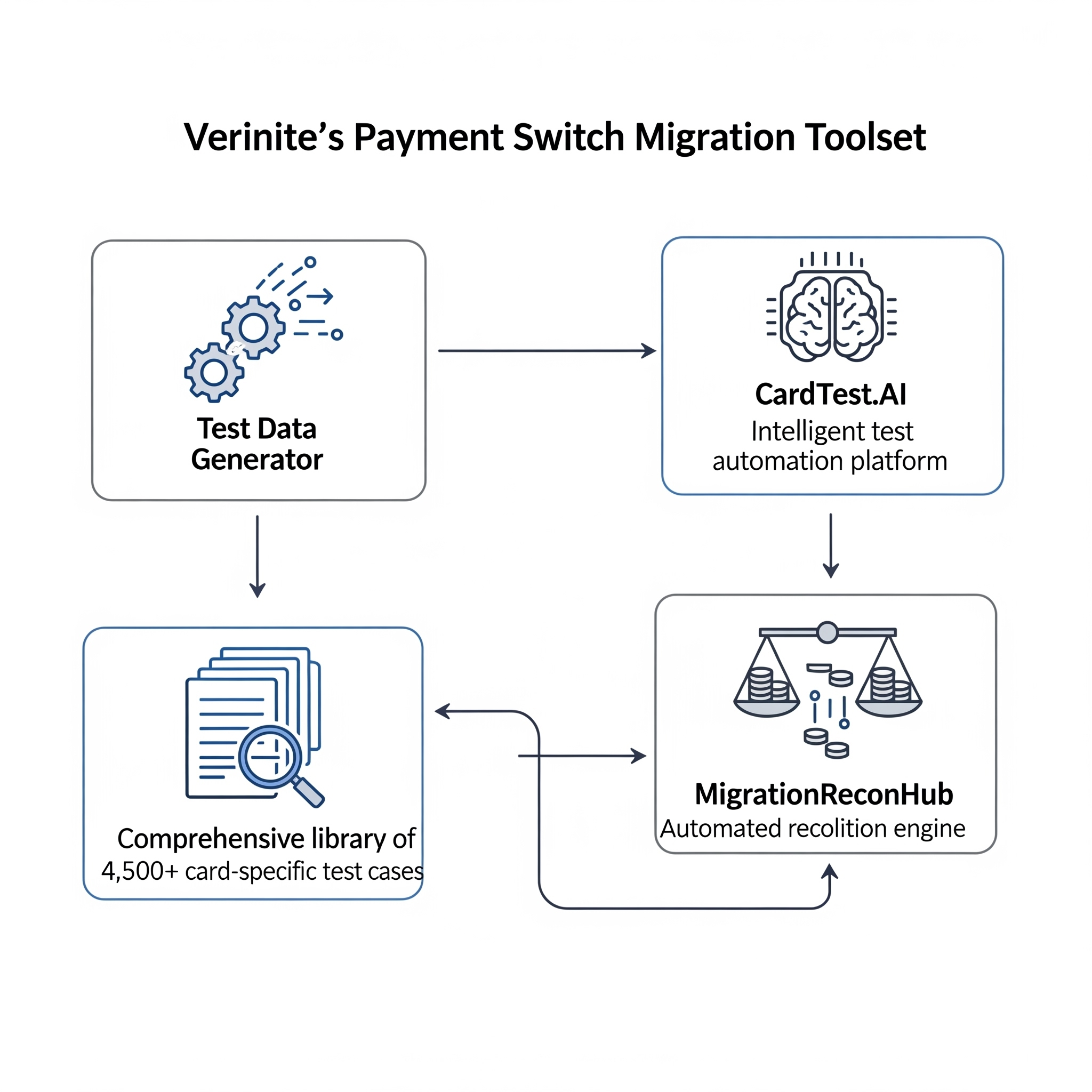

- Intelligent accelerators: CardTest.AI, MigrationReconHub, Test Data Generator

- Strategic partnerships: Fraud platforms, cloud hosts, scheme certifiers

- Offshore delivery excellence with direct SME access—zero layers, zero delays

Ready to modernize? Contact Verinite today!

FAQs

1. What's a payment switch?

It's the system that routes all your financial transactions, like a central brain for payments.

2. Why should I even think about moving to a new one?

Old systems can't keep up with instant payments, digital options, and new regulations; a modern switch is essential.

3. What benefits do I get from upgrading?

You gain agility for new services, high resilience, cost savings, better security, and simpler compliance.